The Real Risk of Black Box AI: Why Treasury Needs Transparency, Not Hype

AI is everywhere in today’s business landscape—and nowhere more urgently discussed than in treasury and finance. Promises of automation, predictive analytics, and instant decision-making have created a sense of inevitability around artificial intelligence. But amid the excitement, one critical concern remains buried beneath the buzzwords: Can you actually trust what AI is doing?

For corporate treasury teams tasked with managing risk, liquidity, and regulatory compliance, the stakes are simply too high for guesswork. And yet, many AI solutions on the market operate like black boxes, offering little visibility into how decisions are made or what data is driving recommendations. That’s not just a tech problem. It’s a strategic risk.

The Problem with “Black Box” AI in Treasury

Black box AI refers to models whose inner workings are not visible to the user. They take in data, produce outputs, and offer little to no explanation of how those results are generated. In consumer contexts, this might be tolerable—think movie recommendations or voice assistants. But in treasury?

Not so much.

Treasury teams need more than predictions. They need proof. Whether it’s explaining a variance in the cash forecast, justifying a hedging decision, or preparing for an audit, transparency and traceability are non-negotiable.

When AI can’t answer questions like:

- Where did this number come from?

- What data informed this decision?

- Was this aligned with internal policy or compliance frameworks?

…it doesn’t solve problems. It creates them.

Why Transparency Is a Business Imperative

Treasury professionals operate in a high-stakes environment where the cost of inaccuracy is real, resulting in missed payments, liquidity shortfalls, regulatory penalties, and reputational damage. Decision-makers in this space need AI that:

- Enhances accuracy without compromising oversight

- Improves efficiency without sacrificing control

- Surfaces insights without masking methodology

That’s why forward-thinking treasury teams are moving away from opaque AI solutions and seeking platforms that deliver clarity, not complexity.

What Transparent AI Looks Like in Treasury

Transparency in treasury AI isn’t just about explainability. It’s about auditability, security, and control. That means your AI solution should:

- Keep your data in-house: No third-party model training. No sending sensitive financials to the cloud.

- Explain its logic: Users should be able to understand how forecasts, recommendations, and alerts are generated.

- Log every action: From data ingestion to approval workflows, every step should be traceable.

- Respect your policies: AI should work within your compliance and governance frameworks—not outside of them.

In other words, you should always be able to say why a decision was made and who approved it.

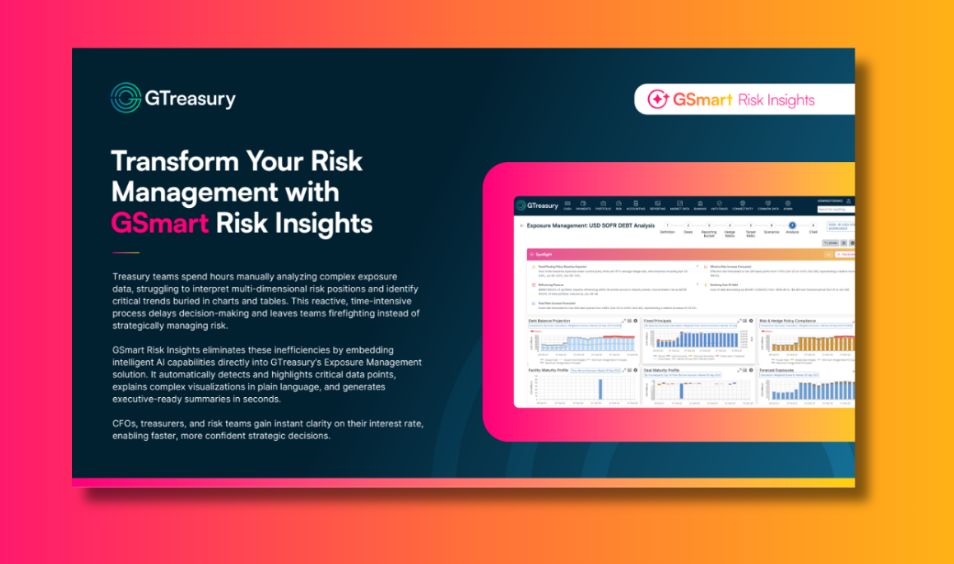

Introducing GSmart AI: Transparent AI, Built for Treasury

At GTreasury, we recognized early that the treasury function needs something fundamentally different from generic AI overlays. That’s why we built GSmart AI, our enterprise-grade, treasury-specific AI platform.

What sets GSmart AI apart isn’t just its forecasting power or automation speed—it’s the confidence it gives you in every output.

Here’s how:

1. Purpose-Built to Amplify Treasury Solutions

GSmart AI is specifically built for treasury and finance solutions to remove operational inefficiencies in data discovery, inference, insights and decision making. GSmart amplifies the output and accuracy of real treasury solutions from connectivity, cash forecasting and AR/AP automation, to risk.

2. Explainable, Auditable AI

Every interaction by GSmart AI is traceable. You can see what data was used, when it was used, and what logic informed the outcome. This makes it easier to defend decisions, answer audit questions, and uphold internal policies.

3. Secure and Accurate Data

Your data stays within your secure GTreasury environment and is never used to train external models or shared with third parties. GSmart AI respects your privacy, your compliance requirements, and your risk profile.

4. AI Oversight and Control

Clients have full control over AI capabilities through feature flags and can restrict which datasets are accessible for AI processing.

The Real Risk Isn’t AI—It’s Using the Wrong Kind

Treasury teams don’t need AI that guesses. They need AI that clarifies. That’s why black box solutions, no matter how impressive they sound in theory, cause a serious risk in practice.

Consider this:

- What happens when your CFO asks why the forecast changed and the AI can’t explain it?

- What do you do when auditors demand documentation, and the system can’t provide a trail?

- How do you ensure compliance when your tools don’t reflect your internal controls?

With GSmart AI, you don’t have to compromise. You get intelligence you can trust, insight you can explain, and automation you can verify.

Final Thoughts: Clarity Is the Competitive Edge

AI is essential for modern treasury teams. But it has to be the right kind of AI. As finance leaders increasingly lean on automation to streamline operations and support decision-making, transparency becomes a competitive advantage.

By adopting GSmart AI, treasury teams can:

- Improve forecast accuracy with real-time data

- Eliminate spreadsheet risk through automated controls

- Build stronger trust with auditors, boards, and leadership

- Spend less time preparing and more time planning

In an era of financial complexity, regulatory scrutiny, and constant change, clarity is power. And with GSmart AI, GTreasury is giving treasury teams exactly that.

The Real Risk of Black Box AI: Why Treasury Needs Transparency, Not Hype

AI is everywhere in today’s business landscape—and nowhere more urgently discussed than in treasury and finance. Promises of automation, predictive analytics, and instant decision-making have created a sense of inevitability around artificial intelligence. But amid the excitement, one critical concern remains buried beneath the buzzwords: Can you actually trust what AI is doing?

For corporate treasury teams tasked with managing risk, liquidity, and regulatory compliance, the stakes are simply too high for guesswork. And yet, many AI solutions on the market operate like black boxes, offering little visibility into how decisions are made or what data is driving recommendations. That’s not just a tech problem. It’s a strategic risk.

The Problem with “Black Box” AI in Treasury

Black box AI refers to models whose inner workings are not visible to the user. They take in data, produce outputs, and offer little to no explanation of how those results are generated. In consumer contexts, this might be tolerable—think movie recommendations or voice assistants. But in treasury?

Not so much.

Treasury teams need more than predictions. They need proof. Whether it’s explaining a variance in the cash forecast, justifying a hedging decision, or preparing for an audit, transparency and traceability are non-negotiable.

When AI can’t answer questions like:

- Where did this number come from?

- What data informed this decision?

- Was this aligned with internal policy or compliance frameworks?

…it doesn’t solve problems. It creates them.

Why Transparency Is a Business Imperative

Treasury professionals operate in a high-stakes environment where the cost of inaccuracy is real, resulting in missed payments, liquidity shortfalls, regulatory penalties, and reputational damage. Decision-makers in this space need AI that:

- Enhances accuracy without compromising oversight

- Improves efficiency without sacrificing control

- Surfaces insights without masking methodology

That’s why forward-thinking treasury teams are moving away from opaque AI solutions and seeking platforms that deliver clarity, not complexity.

What Transparent AI Looks Like in Treasury

Transparency in treasury AI isn’t just about explainability. It’s about auditability, security, and control. That means your AI solution should:

- Keep your data in-house: No third-party model training. No sending sensitive financials to the cloud.

- Explain its logic: Users should be able to understand how forecasts, recommendations, and alerts are generated.

- Log every action: From data ingestion to approval workflows, every step should be traceable.

- Respect your policies: AI should work within your compliance and governance frameworks—not outside of them.

In other words, you should always be able to say why a decision was made and who approved it.

Introducing GSmart AI: Transparent AI, Built for Treasury

At GTreasury, we recognized early that the treasury function needs something fundamentally different from generic AI overlays. That’s why we built GSmart AI, our enterprise-grade, treasury-specific AI platform.

What sets GSmart AI apart isn’t just its forecasting power or automation speed—it’s the confidence it gives you in every output.

Here’s how:

1. Purpose-Built to Amplify Treasury Solutions

GSmart AI is specifically built for treasury and finance solutions to remove operational inefficiencies in data discovery, inference, insights and decision making. GSmart amplifies the output and accuracy of real treasury solutions from connectivity, cash forecasting and AR/AP automation, to risk.

2. Explainable, Auditable AI

Every interaction by GSmart AI is traceable. You can see what data was used, when it was used, and what logic informed the outcome. This makes it easier to defend decisions, answer audit questions, and uphold internal policies.

3. Secure and Accurate Data

Your data stays within your secure GTreasury environment and is never used to train external models or shared with third parties. GSmart AI respects your privacy, your compliance requirements, and your risk profile.

4. AI Oversight and Control

Clients have full control over AI capabilities through feature flags and can restrict which datasets are accessible for AI processing.

The Real Risk Isn’t AI—It’s Using the Wrong Kind

Treasury teams don’t need AI that guesses. They need AI that clarifies. That’s why black box solutions, no matter how impressive they sound in theory, cause a serious risk in practice.

Consider this:

- What happens when your CFO asks why the forecast changed and the AI can’t explain it?

- What do you do when auditors demand documentation, and the system can’t provide a trail?

- How do you ensure compliance when your tools don’t reflect your internal controls?

With GSmart AI, you don’t have to compromise. You get intelligence you can trust, insight you can explain, and automation you can verify.

Final Thoughts: Clarity Is the Competitive Edge

AI is essential for modern treasury teams. But it has to be the right kind of AI. As finance leaders increasingly lean on automation to streamline operations and support decision-making, transparency becomes a competitive advantage.

By adopting GSmart AI, treasury teams can:

- Improve forecast accuracy with real-time data

- Eliminate spreadsheet risk through automated controls

- Build stronger trust with auditors, boards, and leadership

- Spend less time preparing and more time planning

In an era of financial complexity, regulatory scrutiny, and constant change, clarity is power. And with GSmart AI, GTreasury is giving treasury teams exactly that.

Siehe GTreasury in Aktion

Nehmen Sie noch heute Kontakt mit unterstützenden Experten, umfassenden Lösungen und ungenutzten Möglichkeiten auf.

.png)

.png)

.png)

%404x.png)